Too much emphasis is placed on the ‘next trade’ when it comes to trading.

What I mean by that is, too many are worried about maximizing gain and minimizing loss on the next trade that they place.

This comes naturally — our goal as traders is to make money. It follows then, that we should be doing everything we can to make money the next time we interact with the market.

But in my experience, I find this way of thinking to be counter-productive. It’s not wrong per se, but rather a bad mental framework to be operating with.

The reason, in my opinion, is that it gets you into a mindset of worrying about making money or avoiding loss on the next trade. In other words, it’s all about the ‘next trade.’

Key Point #1: don’t think about the next trade — think about the next 100 trades

A big shift in my own trading happened when I stopped placing so much emphasis on the next trade, and began thinking in terms of the next 100 trades. This made all the difference.

Trading is a mentally taxing exercise — the mental and psychological challenges to trading successfully should not be discounted.

Case in point: winning money feels awesome, and taking losses hurts — this is a big part of what makes trading so difficult. It’s hard not to get high on wins and low on losses.

Yet neither is an emotional activity that the successful trader wants to engage in.

Easier said than done — most traders already know this, yet very few actually practice the mental discipline or operate with a correct mindset that allows them to avoid these highs and lows.

Key Point #2: don’t think you’ve ‘figured this game out’ but also don’t think you’re ‘not cut out for trading’

How many traders really keep it ‘all business’ after a handful of wins or losses? Most are either over the moon and think they’ve ‘figured it all out’ after they’ve had a few winning trades, or they’re down in the dumps and think they ‘should just quit’ after a string of losses.

Neither is true — a few wins doesn’t mean you’ve cracked the code to the markets, and a few losses doesn’t mean that you’re ‘just not cut out for trading.’

More than anything, this attitude reveals a flaw in thinking when it comes to profiting as a trader.

Which brings us back to ‘the next trade’ vs ‘the next 100 trades’…

Key Point #3: the next trade means virtually nothing — the next 100 trades mean everything

It’s important as a trader to understand how casinos make money. A casino has no clue how the next role of the dice or the next hand at the blackjack table is going to turn out — whether they’ll take a gambler’s money or take a loss and pay out.

Yet these businesses print money year after year.

The reason is that they know the law of large numbers is on their side — they have a probabilistic edge that they know, without a shadow of a doubt, will play out over a large enough sample of rolls of the dice or spins of the wheel.

That’s the edge that casinos have, and that’s the edge that traders seek in operating in the markets.

But consider what it means for our purposes: would a casino boss ever get angry if they lost a few hands in blackjack or a few spins of the roulette wheel? Would a casino boss get excited after a few hands that went in favour of the casino?

Obviously not — they leave that excitement for the gamblers. They just show up every day and keep the place running, because they know if they do that, they’ll make consistent profit.

Maybe not on the next hand. Maybe not on the next 5 hands. But on a large enough sample, they’ll make money. And knowing that allows them to operate the business day in and day out, not worrying about any single outcome.

Each outcome, statistically, means very little.

Key Point #4: a consistent and repeatable process is more important than a winning trade

Trading is no different. Just like our casino boss, getting excited over a win or upset over a loss makes absolutely no sense. Each moment in the market, just like each spin of the roulette wheel, is unique — no one knows what’s going to happen.

But the trader’s job is not to know what’s going to happen next, but rather to operate the way the casino does — show up every day, take a calculated and appropriately-sized bet that has an edge in their favour, and let the chips fall where they may.

They don’t know if that means they’ll win the next trade, but they do know that if they execute that same strategy on the next 100 trades, they’ll be profitable.

If this is all true (and I believe it undoubtedly is), then having any emotional attachment to the last trade, and any anxiety about the next trade, makes no sense.

If you win on the next trade, that’s great, but it only means something in relation to the next 99 trades after it. If you lose, the story is the same.

Key Point #5: it’s all about the Profit Factor

Once you internalize this way of thinking about trading, you start to see upside, downside, and risk in a different light. You stop worrying about the outcome on your next trade or your current open position.

Instead, you start considering how best to optimize your trading system and routine to produce profits over a large sample of trades.

You start focusing on doing the right thing on every trade you take and let go of the emotional highs of wins and emotional lows of losses.

You start to think about how much you win when you win.

You start to think about how much you lose when you lose.

You start to think about how often you win vs how often you lose.

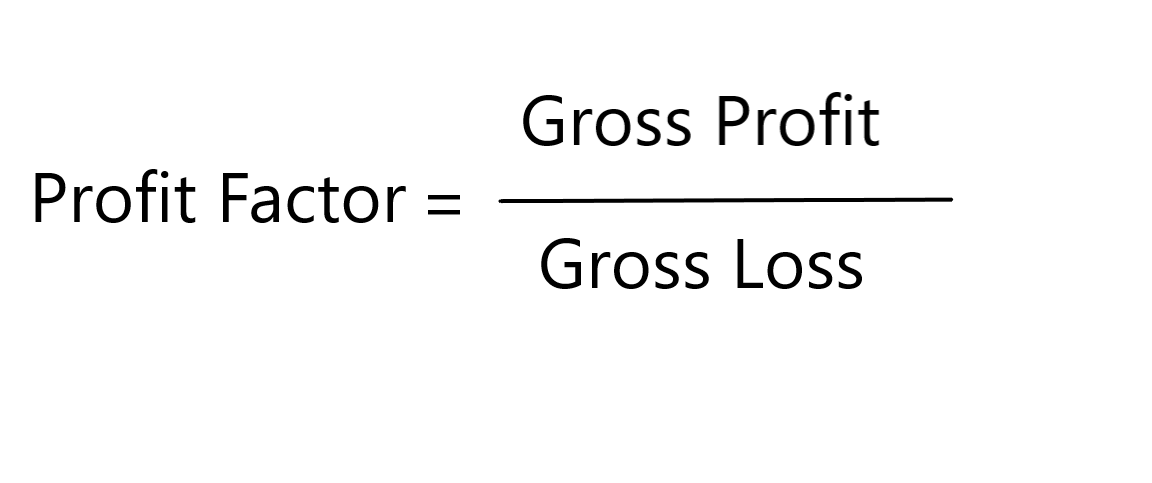

These are the components to your Profit Factor, and your Profit Factor is what determines whether you’re making or losing money:

How much you win when you win

How much you lose when you lose

How often you win vs how often you lose (win rate)

Thinking in terms of Profit Factors gets you away from the emotions of each trade, and instead focuses your mind on executing and improving a repeatable trading system over the long term — on doing the right thing on each trade so that, no matter what happens on the ‘next trade,’ over the next 100 trades, you’ll be profitable.

As an aside, when developing your trading styles/strategies/systems, be methodical in this: know your trading style and what it will take to be profitable. If you have a low win rate strategy, you need larger wins to make up for the higher percentage of losers. If you have a high win rate, you can afford to have smaller wins.

The math is inescapable — the smaller the win rate, the larger your wins have to be, and vice versa.

Quick side note on how it works:

A Profit Factor above 1 means you’re making money, while a Profit Factor below 1 means you’re losing money. Think of it as, for every $1 you put up (or risk), what do you make back (or get in return), on average, over X amount of trades?

A Profit Factor of 2 (which is excellent) means that for every dollar you risk, you return $2 on average.

In conclusion

Ultimately, what you want to be focusing on as a trader is the long-term. Think about trading as a business that makes money the same way a casino makes money. Think about what you need to do on each of the next 100 trades to be profitable, rather than on the outcome of the next trade.

One last point — the reason many DON’T do this is not due to a lack of knowledge — it’s due to the fact that, in life and in trading, most people hate to lose, they feel pain when losing (especially when losing money), they hate to be wrong, they hate to admit that they were wrong, and they hate facing and acknowledging their losses.

Accepting the Profit Factor as fact means acknowledging that losses are a huge part of the trading process and are in fact critical to whether you succeed or fail. Unconsciously, most of us are simply unwilling to do this. Most hate the very idea of losing. Instead, most hope to win but fear to lose.

This is some hardwired stuff in our brains, and it’s not as easy to accept and overcome these internal biases as it may sound. It takes a lot of losing and a lot of pain before these truths are internalized.

Which leads us to our final point…

Key Point #6: the best traders are the best losers

A good trader knows how to lose. A good trader knows that losses will happen and are unavoidable.

What matters is not the ‘next trade’ or one great winning trade, but rather how your losses interact with your winners over a large sample of trades.

Accept losses as part of trading and a critical piece to your success. Because they are.